The beleaguered EV startup Lordstown Motors is on track to begin production of its flagship electric truck Endurance, but only select customers will begin to receive vehicles early next year, executives said during a second quarter earnings call.

Executives struck a cautious tone in the second-quarter earnings call as they tried to assuage shareholder concerns and address the near-term realities of bringing its first vehicle to market without any revenue to offset its costs. Lordstown’s approach, at least this quarter, was to try and reduce operating costs from the previous quarter, helping it offset its increase in capital expenditures.

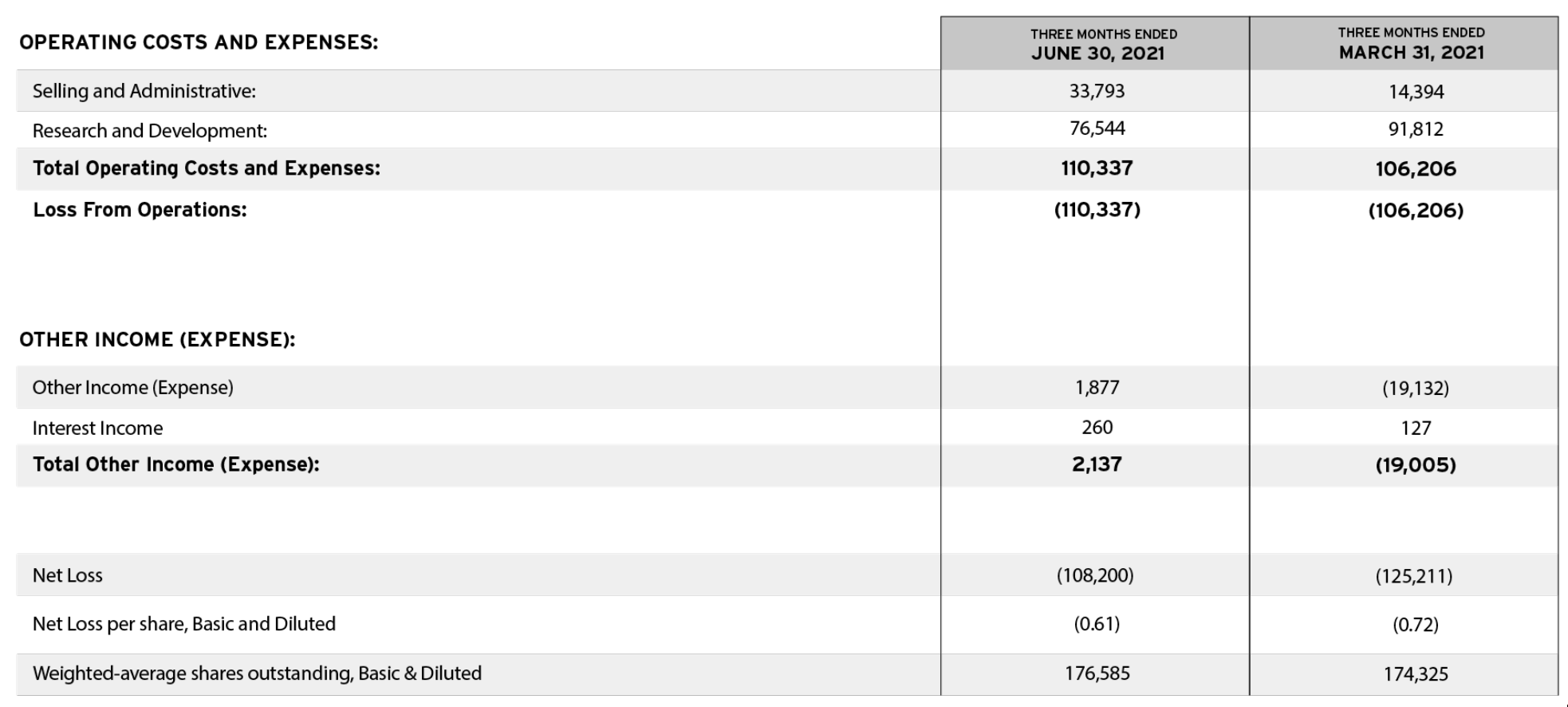

Lordstown reported a net loss of $108 million, a 13.7% improvement from the first quarter loss of $125 million. Its net losses are more than tenfold higher than the -$7.9 million it reported in the same period last year.

Lordstown cut research and development spending by 17% from the previous quarter to $76.5 million.

Meanwhile, it increased its capital expenditures to $121 million from $53 million in the first quarter. Lordstown also increased its capital expenditure guidance for the year, from $250 million to $275 million to a $375 million to $400 million range, a spike related to its need to prepay for equipment.

Image Credits: Lordstown Motors (opens in a new window)

The decline in R&D expenses was due to declines in purchases of vehicle components, as many of those were acquired in prior quarters, Lordstown interim CFO Becky Long said during an investor call. However, legal expenses were $9 million higher than last quarter, due to costs related to a special committee and a Securities and Exchange Commission investigation over whether Lordstown exaggerated pre-sales. (The fun doesn’t stop there — the company is also under investigation by the U.S. Attorney’s Office for the Southern District of New York.)

Lordstown was thrown a life vest earlier this summer, when investment firm Yorkville Advisors agreed to purchase up to $400 million of Lordstown’s shares. The company is “now exploring a variety of other financing options, including non-dilutive private strategic investments and debt,” interim CEO Angela Strand said during an investor call. The company is also still pursuing a loan with the U.S. Department of Energy, Long said during the call.

Although the company said it was still on track to begin production of the Endurance at the end of September, only “select early customers” will begin to receive vehicles in the first quarter of 2022, followed by commercial deliveries in the second quarter. Strand said this deployment plan is to allow fleet customers time to build out charging infrastructure and to manage supply chain challenges.

One thing that distinguishes the company from some of its competitors is its manufacturing plant — a 6.2 million square foot former General Motors plant in Lordstown, Ohio. It’s now looking like the company is exploring different ways to turn a profit off this asset. Strand said “serious discussions” were underway with potential partners to use Lordstown’s facility to manufacture their products, suggesting the company is eager to find additional sources of revenue to offset its mounting expenses. “This is a critical strategic pivot for us, a decision that we believe will lead to significant new revenue opportunities for Lordstown,” she said.

“We are exploring multiple partnership constructs,” she added. “That includes contract manufacturing, that includes licensing, in addition to producing our own vehicles,” she added.

The Lordstown executive team has not had a smooth summer. The company announced in June the resignations of both CEO Steve Burns and CFO Julio Rodriguez, who were replaced in an interim capacity by Strand and Roof respectively. Lordstown was founded as an offshoot of Burns’ company Workhorse Group — the same company that said it had sold 11.9 million shares, or nearly three-quarters of its stake, since the beginning of July. The company is actively searching for a CEO and CFO, Strand said.

Lordstown was riding high in late 2020, when it announced its SPAC merger with a value of $1.6 billion. Its shares soared to $31.80 apiece at their 52-week highs. They’ve since plummeted to $5.94.

“We still plan to be first to market, particularly in the commercial fleet space,” Strand said.

Powered by WPeMatico