Serial entrepreneur Rohit Nadhani, who last sold his Newton email app to Essential in 2018— an app so popular it’s been saved from shutting down multiple times — is today launching a new startup, Kubera. The service aims to offer an alternative to using a spreadsheet to keep track of your assets, investments, cryptocurrencies, debts, insurance, and other important documents that would need to be transferred to a loved one in the event of your death.

The founder was inspired to create Kubera — a reference to the Indian “lord of wealth” — due to a traumatic personal experience. While swimming in Costa Rica, he was caught in a riptide and had to be rescued. After coming home, the first thing he did was to start putting together a list of all his assets to share with his wife in the event of his death.

The task was fairly difficult, as it turned out, as that list now included more than just real estate, stocks and bonds, retirement accounts, and insurance.

Nadhani realized he also wanted to list other assets like crypto investments, collectibles, precious metals, private and foreign investments, trademarks and other digital assets, as well as debts owed him — like loans he had made to family and friends.

Plus, he wanted a few more features that a simple spreadsheet could provide — like the ability to automatically update the value of the assets, similar to Intuit’s Mint, and basic reporting. More importantly, he didn’t want to share access to his personal net worth data and accounts unless it was absolutely necessary.

Existing solutions didn’t meet Nadhani’s needs, he said, as they used outdated technology, lacked the features he wanted, or used users’ data to make budgeting or investment recommendations. That, along with feedback from friends who said they were also stuck using spreadsheets for this task, prompted the founder to create his own solution with Kubera.

To do so, he reached out to former colleague Manoj Marathayil, the founding engineer at Nadhani’s two prior companies, CloudMagic (Newton) and Webyog, which exited to IDERA in 2018. Also joining Kubera is the former Head of Product & Design from Newton Mail at CloudMagic, Umesh Gopinath.

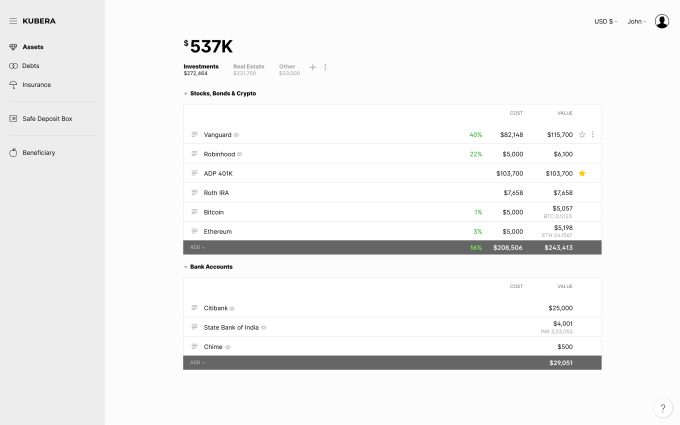

Kubera is launching today as a custom-built solution for the task of listing your assets, both traditional and non-traditional alike.

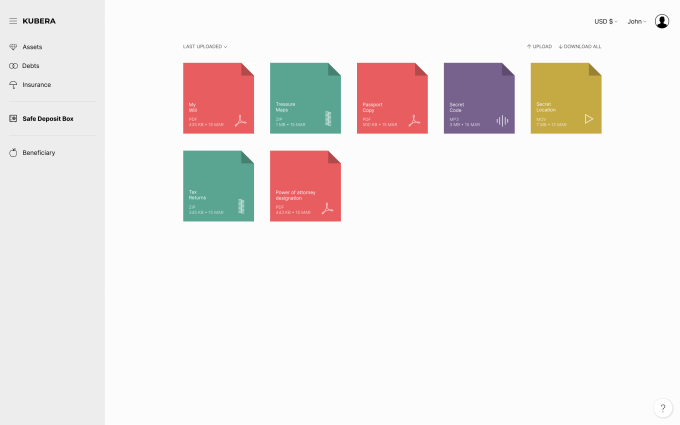

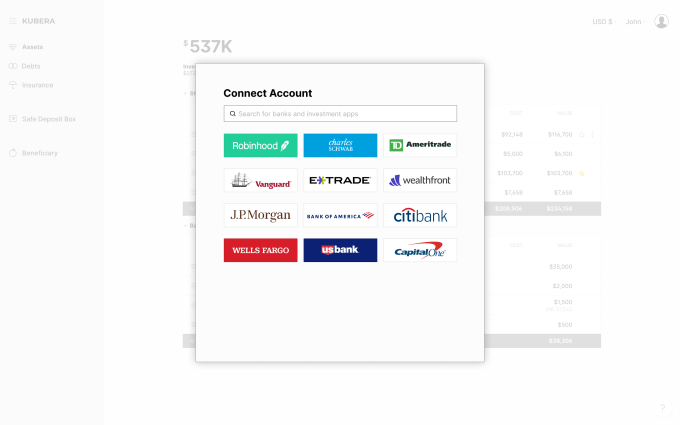

To use the service, you begin by listing your assets in a simple table, then add details like cost, value, or the documents associated with them, if available. You can either opt to update the values in the table as you go, or you can connect assets to your online accounts to update their value automatically.

The service uses trusted financial data aggregation services like Plaid and Yodlee to make the connections, which means it has “read-only” access to your financial data — Kubera cannot make transactions on your behalf. This also allows it to support connections to over 10,000 banks across the world.

The service also uses the open standard AES-256 encryption algorithm to encrypt user data, requires HTTPS on all web pages, uses HSTS to require browsers use only secure connections, and supports 2-step verification through Google Sign-in with other 2-step options launching soon.

The company’s business model is a subscription service, which allows it to generate revenue without having to share data with a third-party or advertiser. The basic service is free to use if you don’t want to automatically update your asset values. If you do, it’s $10 per month.

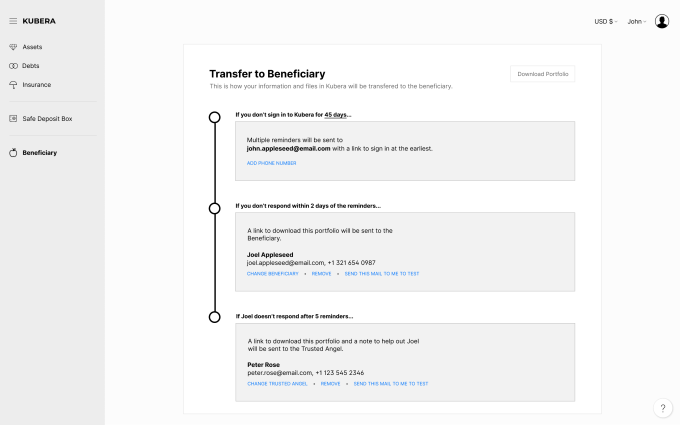

Once the initial entry has been done, Kubera will periodically remind you to update asset values and check in. Its “life beat” check will track if you’ve been inactive for a certain number of days (specified by you during setup) and try to reach you.

If you don’t respond to Kubera’s attempts to reach you, it will then try to reach your beneficiary by way of email and text, if provided. The service sends an email with all the information you’ve provided in a downloadable format to your beneficiary. If they don’t respond after several reminders, Kubera will then reach out to your backup contact, a “Trusted Angel.”

Kubera to some extent competes with services like Mint, YNAB and other online budgeting tools. But these services don’t offer the same extensive net worth tracking and have a different focus. It also competes with financial advisor and wealth management companies, like Personal Capital. But instead of pushing you to connect with a financial advisor or other paid services, Kubera isn’t doling out investing advice.

Further down the road, Kubera may expand into estate planning — like helping with wills or trusts, or connecting you to partners who can provide these services. But for the time being, the service is meant to be used in conjunction with users’ existing wills and trusts.

The bootstrapped startup is a five-person team. At launch, Kubera is offering 100-day free trials, allowing you the time to organize assets before making a decision on subscribing to the service.

Powered by WPeMatico