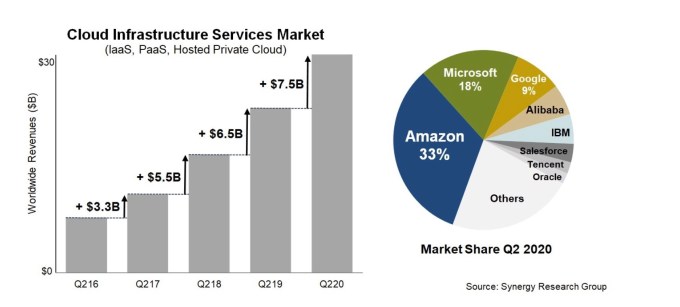

While the overall cloud infrastructure market is booming having reached $30 billion last quarter worldwide, Oracle is struggling with market share in the low single digits. It is hoping that the Zoom and TikTok deals can jump start those numbers, but trying to catch the market leaders Amazon, Microsoft and Google, never mind several other companies ahead of it, is going to take a lot more than a couple of brand name customers.

By now, you know Oracle and TikTok were joined together in unholy acquisition matrimony last month in the acquisition equivalent of a shotgun wedding. In spite of that, Oracle founder and chief technology officer Larry Ellison gushed in a September 19 press release about how TikTok had “chosen” his company’s cloud infrastructure service. The statement also indicated that this “choice” was influenced by Zoom’s decision to move some percentage of its workloads to Oracle’s infrastructure cloud earlier this year.

The mechanics of the TikTok deal aside, the question is how big an effect will these two customers have on the company’s overall cloud infrastructure market share. We asked a couple of firms who closely watch all things cloud.

John Dinsdale, chief analyst at Synergy Research Group, wasn’t terribly optimistic that they would have much material impact on moving the market share needle for the database giant. “Oracle’s cloud infrastructure services growth has been consistently below overall IaaS and PaaS market growth rates so its market share has [actually] been nudging downward. Zoom may be a good win but it is unlikely to move the needle too much — and remember Zoom also buys cloud services from AWS,” Dinsdale told TechCrunch.

As for TikTok, Dinsdale, like the rest of us, wasn’t clear how that deal would ultimately play out, but he says even with both companies in the fold, it wasn’t going to shift market share as much as Oracle might hope. “Hypothetically, even if Zoom/TikTok helped Oracle increase its cloud infrastructure service revenues 50% over 12 months, which would be a real stretch, its market share would still be nearer to 2% than 3%. This compares with Google at 9%, Microsoft 18% and AWS 33%,” Dinsdale said.

He did point out that the company’s SaaS business is much stronger. “Broadening the scope a little to other cloud services, Oracle’s SaaS growth is running roughly in line with overall market SaaS market growth so market share is steady. Oracle’s share of the total enterprise SaaS market is running at around 6%, though if you drill down to the ERP segment it is obviously doing much better than that,” he said.

Canalys, another firm that follows the cloud infrastructure market says their numbers tell a similar story for Oracle. While it’s doing well in Saas with 7.8% market share, it’s struggling in IaaS/PaaS.

“For IaaS/PaaS, Oracle Cloud is at 1.9% for Q2 2020 and that isn’t moving much. The top three providers are AWS, Azure and Google Cloud, who have 30.8%, 20.2% and 6.2% respectively,” Blake Murray from Canalys told TechCrunch.

It’s worth keeping in mind that Google hired Diane Greene five years ago with the hope of accelerating its cloud infrastructure business. Former Oracle exec Thomas Kurian replaced her two years ago and the company’s market share still hasn’t reached double digits in spite of a period of big overall market growth, showing how much of a challenge it is to move the needle in a significant way.

Another big company, IBM bought Red Hat two years ago for $34 billion with an eye toward improving its cloud business, and while Red Hat has continued to do well, it does not seem to have much impact on the company’s overall cloud infrastructure market share, which has been superseded by Alibaba in fourth place, according to Synergy’s numbers. Both companies are in the single digits.

Image Credits: Synergy Research

All that means, even with these two clients, the company still has a long way to go to be relevant in the cloud infrastructure arena in the near term. What’s unknown is if this new business will help act as lures for other new business over time, but for now it’s going to take a lot more than a couple of good deals to be relevant — and as Google and IBM have demonstrated, it’s extremely challenging to gain chunks of market share.

Powered by WPeMatico