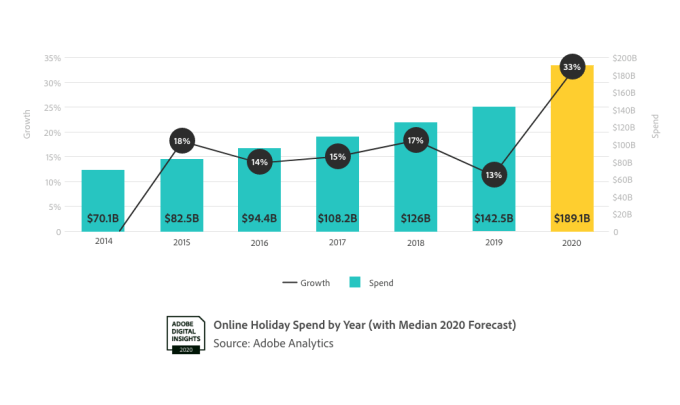

The accelerated shift to e-commerce due to the pandemic will have a significant impact on U.S. online holiday sales, according to a new forecast from Adobe Analytics. Adobe Analytics predicts that U.S. online sales for the months of November and December 2020 will reach $189 billion, representing a 33% year-over-year increase and setting a new record.

The forecast is also equal to two years of growth in one season, Adobe says, noting that the increase in 2019 was just 13%.

Image Credits: Adobe Analytics

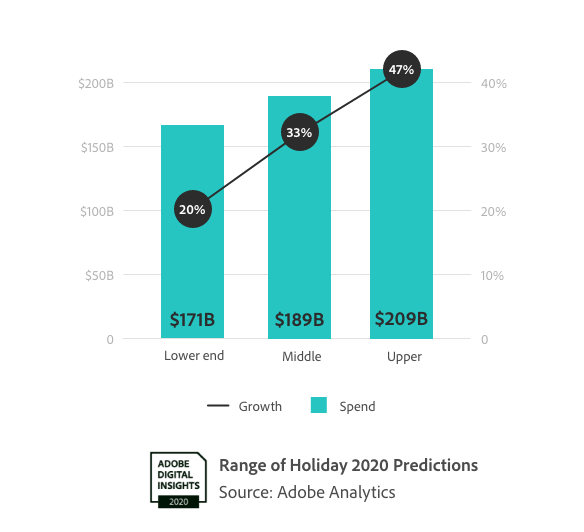

If consumers receive another round of stimulus checks and physical stores are again shut down in large parts of the country to address further coronavirus outbreaks, the figures could go even higher. In that case, consumers would then be expected to spend an additional $11 billion online, bringing total sales to more than $200 billion, or a 47% year-over-year increase.

Image Credits: Adobe Analytics

The way consumers shop this season may look different too.

Typically, the online shopping season began with Black Friday sales — a digital counterpart to the offline sales events taking place in physical stores. This would then bleed into Cyber Monday sales, as consumers looked online for the items they couldn’t find deals on when shopping in person.

Over the years, the lines between the individual sales events began to blur. Online shopping shifted to Thanksgiving Day, for example, and then stretched past Cyber Monday.

This year, Adobe Analytics expects the so-called “Cyber Week” (Thanksgiving through Cyber Monday) to turn into “Cyber Months.”

Image Credits: Adobe Analytics

This will be driven, in part, by significant holiday discounting that begins the first two weeks of November, building up to the deepest price cuts over the Black Friday holiday weekend and Cyber Monday.

Adobe Analytics also predicts online sales will surpass $2 billion every day from November 1 through November 21, and will then increase to $3 billion per day from November 22 through December 3.

Black Friday online sales are projected to climb 39% year-over-year, to $10 billion, while Cyber Monday becomes the biggest online shopping day of the year, with $12.7 billion in sales, a 35% year-over-year jump.

Image Credits: Adobe Analytics

The best deals for TVs and appliances will continue to be on Black Friday, while the best deals for toys and furniture will arrive on Sunday, November 29 — the day before Cyber Monday. Sporting goods will see their best deals on December 13 and electronics on December 18, Adobe says.

As in previous years, mobile will claim an ever-larger contributor chunk of e-commerce spending, with U.S. consumers spending $28.1 billion more on their smartphones in 2020 than in 2019, a 55% year-over-year increase.

Smaller retailers ($10 million-$50 million in annual online revenue) will also benefit from the increased online activity. They’ll see a larger (107% increase) boost to their online revenue than larger retailers with $1 billion-plus in revenue, which will see an 84% increase.

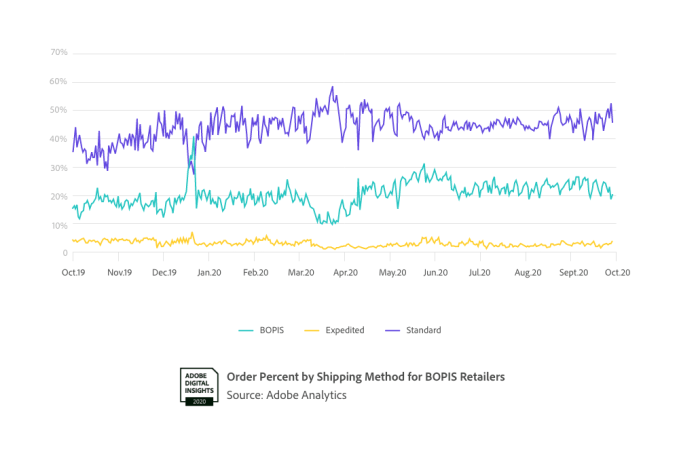

As some U.S. consumers may not be traveling to see family this year, compared with pre-pandemic years, Adobe Analytics predicts Americans will spend 18% more on gifts that are directly delivered from the retailer to people they would have otherwise seen in person. But consumers are not interested in paying more for expedited shipping — 64% said they won’t pay for a speedier service. That means retailers will need to continue to clearly communicate about their free shipping cut-off dates.

Image Credits: Adobe Analytics

The trend toward buying online and picking up in store (BOPIS) will surge, too. With the addition of curbside pickup options from many retailers, BOPIS will see 40% more orders than last year and will grow to represent 50% of all orders from retailers offering the option in the week before Christmas.

Due to the pandemic, Adobe Analytics expects 9% of all holiday customers to be net new online shoppers. Conversion rates will increase as well, at +13%, while revenue will increase +33%. Average order value, however, will remain flat.

One factor that could complicate these predictions is the U.S. election. In previous election years, online sales were impacted after the outcome was known. They dropped 14% the day after the 2016 election, and 6% the day after the 2018 midterms. According to Adobe Analytics, 26% of consumers said the election’s outcome would impact their holiday spending.

The data used to make these predictions is sourced from Adobe Analytics, which today analyzes one trillion visits to U.S. retail sites. This includes 100 million SKUs and 80 of the 100 largest retailers in the U.S., the company says.

Powered by WPeMatico