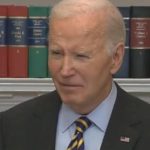

BRENDAN SMIALOWSKI/AFP via Getty Images

- German lender Deutsche Bank is seeking to dump about $340 million in debt owed by President Donald Trump, Reuters reported on Tuesday.

- The bank will seek to sell its loans to Trump after the election, or seek repayment of the money, which becomes due in two years, sources at the bank told the agency.

- Trump’s ties with Deutsche Bank have long been scrutinized. Deutsdche handed over records to Manhattan’s district attorney, who is investigating alleged crimes by Trump’s businesses.

- Trump has long denied allegations on wrongdoing in his business dealings.

- Visit Business Insider’s homepage for more stories.

German lender Deutsche Bank is planning on cutting ties with President Donald Trump after the election, three sources at the bank told the Reuters news agency.

Deutsche will seek to sell, or demand repayment for, the president’s $340 million in outstanding loans, according to the report, published on Election Day.

Trump’s ties with Deutsche Bank have long been the source of rumor and scrutiny. The bank over the years has been the biggest lender to the Trump Organization, the umbrella company that runs Trump’s hotels, golf resorts, and other businesses.

But, per Reuters, the bank is now reportedly keen to shed its last connection to the president — three loans totalling $340 million, personally guaranteed by the president, and taken against the value of his properties.

The loans are said to be due for repayment in the next two years.

According to Reuters, bank executives are not concerned about the president’s capacity to repay the loans, and the time left before they are due.

The agency said that the executives believe the loans will be easier to sell on to another financial institution should Trump lose office.

Given that the loans are personally guaranteed by Trump, if he cannot repay them or refinance, Deutsche Bank could foreclose on the loans and seize the president’s assets, the sources told Reuters.

Business Insider has requested comment from the White House on the report. Deutsche Bank declined to comment.

Business Insider has attempted to contact the Trump Organization for comment, which was not reachable via its regular channel. Trump Organization officials did not respond to requests for comment from Reuters.

At an NBC News town hall event in October, Trump shrugged off questions about a New York Times report claiming that he is up to $421 million in debt, arguing that it represented only a “tiny percentage” of his worth.

The Times was the first to report that Trump had personally guaranteed the debt, an assurance sought by lenders when they’re not sure if the borrower will be able to repay.

Congressional investigators and prosecutors in New York have long sought information about Trump’s ties with Deutsche Bank, which was one of the few companies to lend to Trump after his businesses ran into trouble in the 1990s.

Two House committees have issued subpoenas to the bank for information relating to its dealings with Trump, but the president has sued to block the subpoenas, arguing that they were made for political purposes, and that there is no credible evidence of wrongdoing.

In August, The New York Times reported that the bank had complied with a subpoena from Manhattan’s district attorney, Cyrus Vance, as part of a criminal probe into Trump’s businesses.

Trump has long denied allegations of wrongdoing in his financial affairs and business dealings.

Powered by WPeMatico