Future Retail, India’s second largest retail chain, is scaling down its operations to reduce losses, it said, the latest casualty in its years-long battle with estranged partner Amazon.

The firm, led by Kishore Biyani, said in filings to the stock exchanges that it has been finding it “difficult to finance the working capital needs,” and its losses at store level are “increasing” and of “grave concern.”

Future Retail has lost about $593 million in the last four quarters, it said in the filings.

The admission follows a local media report that said Reliance Industries – which entered into a now-hotly contested $3.4 billion deal to acquire several operations of Future Retail – was taking over about 200 of Future’s 1,700 stores and absorbing as many as 30,000 workers of the smaller retail giant after brokering deals with landlords.

Reliance will rebrand those outlets as its own, Business Standard reported. Reliance Industries had no comment.

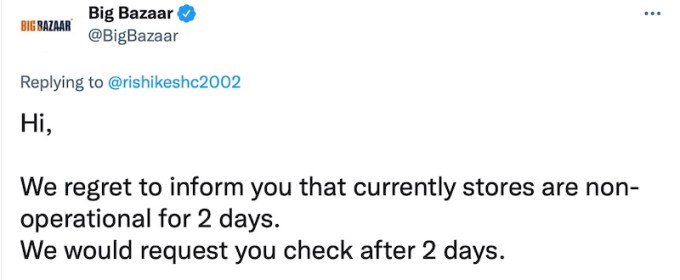

India’s Future Retail operates over 1,700 stores across brands including Big Bazaar. On Sunday, Big Bazaar told customers that its stores were not operational for two days.

Reliance Retail operates the largest retail chain in India. Shortly after it announced that it will acquire Future Group’s retail, wholesale, logistics and warehousing businesses, things started to get complicated.

Amazon, which had invested in one of Future Group’s units three years ago, accused Future Retail of violating its contract and approached the Singapore arbitrator to halt the deal between the Indian firms.

At the time of the partnership with Amazon, a Future Group spokesperson said the American giant’s investment “provides an opportunity for us to learn global trends in digital-payments solutions and launch new products.”

Amazon’s deal with Future Retail had given the American e-commerce giant the first right to refusal on purchase of more stakes in Future Retail, Amazon has argued.

The Indian firms, in return, said in 2020 that the Singapore’s court order wasn’t valid in the South Asian market. India’s watchdog Competition Commission of India also approved the deal between the Indian firms.

In August last year, India’s Supreme Court ruled in favor of Amazon to stall the sale of Future Retail.

“The ongoing litigation initiated by Amazon in October 2020, and which is continuing for the last one and a half years, has created serious impediments in the implementation of the Scheme, resulting in severe adverse impact on the working of the company,” Future Retail told (PDF) the stock exchange.

Amazon identifies India as a key overseas market. The firm, which has invested over $6.5 billion in its India operations, has also bought stakes in More chain of supermarkets and hypermarkets and department-store chain Shoppers Stop in the country.

Powered by WPeMatico