Late-stage SaaS startups may be in the most trouble when it comes to changing valuation marks among technology companies, new data indicates.

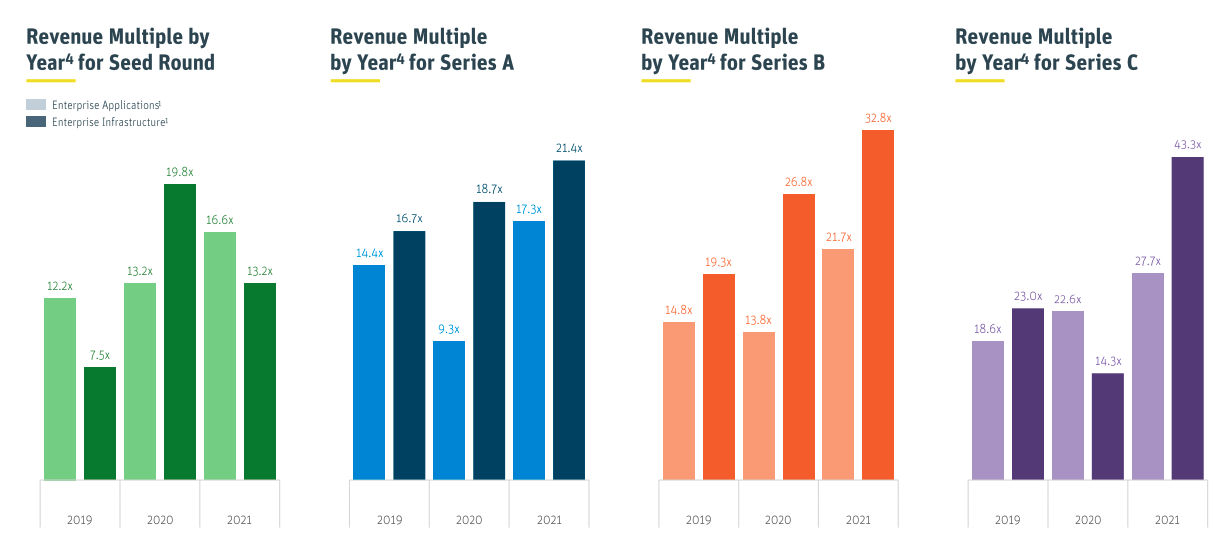

A report from Silicon Valley Bank (SVB) exploring first-quarter software startup trends details that late-stage SaaS valuations in the United States scaled the most rapidly in 2021, closing out the year with the highest revenue multiples of their peer set.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

It’s well-known that the rapid inflation of the value of software stocks in the wake of the pandemic’s onset in 2020 and through much of 2021 provided rocket fuel to late-stage startup valuations. But just how much damage late-stage SaaS startups may have ahead of them is only now coming clear.

Recall that the market is already seeing an uptick in layoffs and some unicorns are looking to re-price their equity for employee retention purposes.

Is it ironic that the startups whose valuation rose the most appear set to endure the largest correction? No. It’s causal. Let’s talk about why.

Is it ironic that the startups whose valuation rose the most appear set to endure the largest correction? No. It’s causal. Let’s talk about why.

What goes up

We’re on the precipice of first-quarter venture capital data, which means that it’s nearly time to retire 2021 results as temporally pertinent.

But under the deadline, observe how SVB details how revenue multiples scaled for two subsets of the United States’ SaaS market — enterprise apps (lighter colors) and enterprise infrastructure (darker colors):

Image Credits: Silicon Valley Bank. Used with permission.

Powered by WPeMatico