Many people have plenty of online subscriptions that they barely use, and can save a fair amount of money with a service like Truebill to see all their recurring payments in one place. Spendflo wants to do the same for enterprise subscribers of SaaS services, and is targeted toward chief financial officers and finance leadership teams.

The startup announced today that it has raised $4.4 million in seed funding led by Accel India and Together Fund, with participation from BoldCap and Signal Peak Ventures, along with founders and operators from companies including Airbase, Zuora, Ivanti, CleverTap, Slintel, Lamda Test, Haptik and Wingify.

Since its launch six months ago, Spendflo claims it has saved 23% on average for its customers. Its clients include Airmeet, Cronwpeak, Lambda Test, Urban Company, WIntify and Yellow.ai.

Founded in 2021 by Siddarth Sridharan, Ajay Vardhan and Rajiv Ramanan, Spendflo gathers all SaaS contracts into one place, giving companies visibility into spending. It also provides assisted purchasing and says it can guarantee savings with proprietary benchmarking data. The company was part of the first cohort of Atoms, an Accel program for pre-seed startups with $250,000 in non-dilutive capital.

Sridharan told TechCrunch that while working at Volta Charging as an early employee, he “saw the company go from seed to IPO during my tenure. In this time, I brought over $10 million of SaaS tools myself.” He added that his CFO would consult him every quarter, instructing him to cut down spending by half.

“Honestly, it was a real pain since I had at least 150 different subscriptions at the time and SaaS buying had become decentralized along with no visibility in pricing and renewals,” Sridharan said. “But, in that phase, it struck me that perhaps other folks were also facing the same issue. So I started asking around in finance communities to figure out if there could be a solution for this.”

SaaS buying is decentralized because it’s not just CIOs who buy SaaS anymore, but every stakeholder, Srdiharan added. “The challenge here is that current SaaS buying happens through popular but unreliable channels such as G2 REviews, Quora and Reddit for pricing information. Approvals end up being stuck in endless email trials.”

On the other hand, Spendflo gives companies a centralized place to track their SaaS spending and usage.

As a use case, Sridharan told TechCrunch about Airmeet’s experience with Spendflo. First it onboarded Airmeet onto its platform and enabled them to centralize contracts and visualize spending. Then the platform’s strategic buyer and CMS worked on creating a buying roadmap based on Airmeet’s needs. Finally, Spendflo’s buying team took over procurements, streamlined the entire process and started saving money. Sridharan said that after using Spendflo, Airmeet’s procurements now happen 3X faster, and save over 16% of their SaaS expenses.

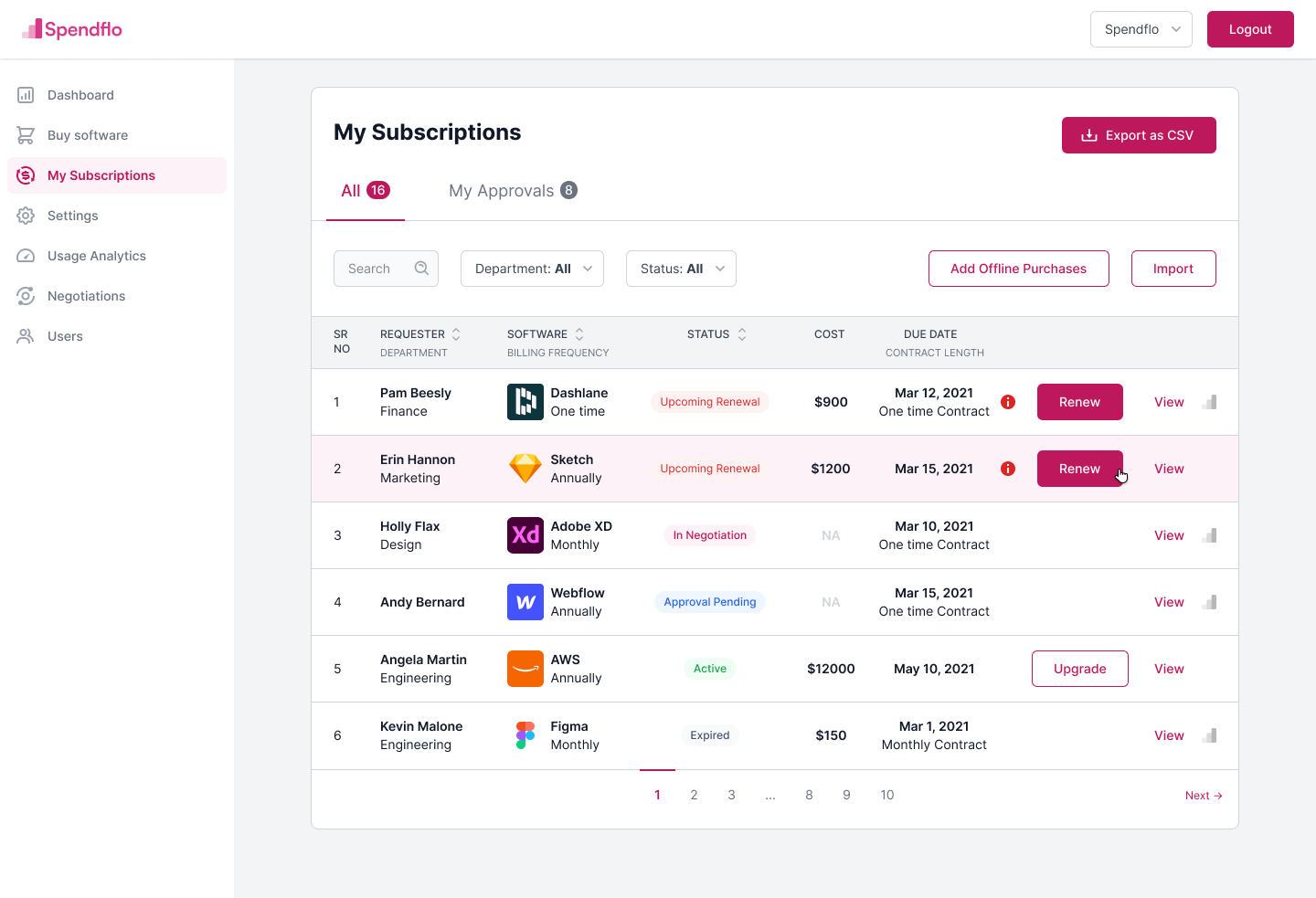

Spendflo’s subscriptions dashboard

Sridharan added that small and large companies spend close to $330 billion on SaaS services, in addition to spending about $1 trillion on their own IT. “Spending on SaaS products grows 25% year on year. SaaS has become the only spend that CFOs have no visibility or control over. We have come to realize that the CFO’s role is evolving,” he said. “It is not just accounting anymore. Legal, ESG and FinOps, among others, are all rolling up to the CFO. The CFOs are no more the referee who blows a whistle, but they are now becoming a point guards inside the company.”

Spendflo sells to finance teams,, working closely with department, security and department heads. Sridharan said he usually sees an average of six stake holders in the buying process for SaaS tools. But, he added, Spendflo “follows a holistic approach,” which means it enables every SaaS buyer to raise and renew requests, view all tools, contracts and security documents, and collaborate with vendors on renewals and new procurement.

The company monetizes by charging a fixed fee on the total SaaS spend that it manages. Sridharan said that it provides a money-back guarantee on the subscription fee, making it budget neutral for finance organizations to adopt our services. “We consistently show 2x to 5x ROI savings. On average, we save 23% on their annual SaaS spend.”

In a prepared statement, Accel India partner Dinesh Katiyar said, “Pay-by-use SaaS tools have been a boon for companies worldwide. They’re all rapidly shifting toward vendors that offer these tools. However, the mass exodus to SaaS has created a new challenge. Instead of centralized procurement workflows, we now have each business function buying what they need. They overspend through unoptimized pricing plans, under-utilized tiers and unused licenses. Spendflo is committed to bringing back spending efficacy without compromising business velocity.”

Powered by WPeMatico