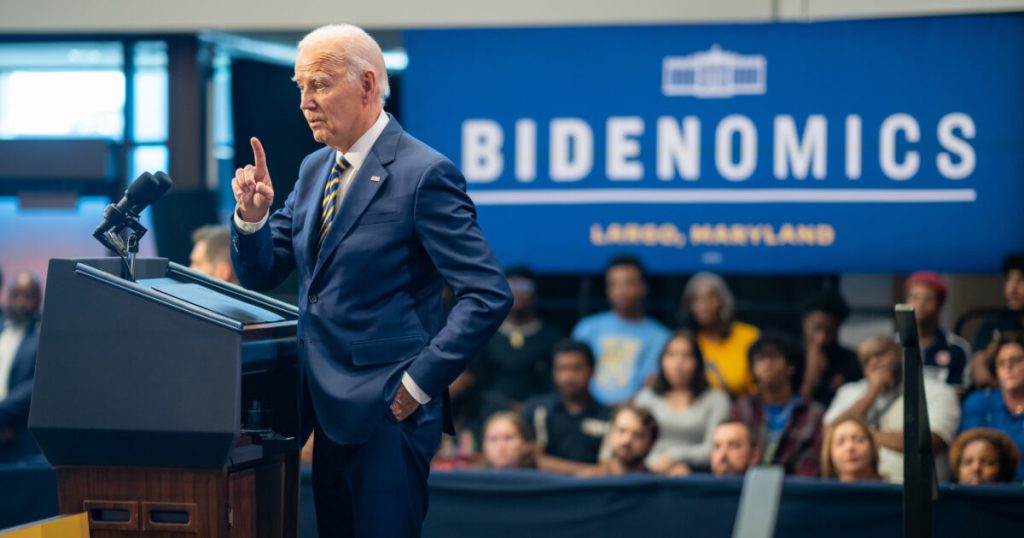

President Joe Biden delivers a speech on the U.S. economy and “Bidenomics”, Thursday, September 14, 2023, at Prince George’s Community College in Largo, Maryland.

(Official White House Photo by Adam Schultz)

This article originally appeared on WND.com

Guest by post by Bob Unruh

Inflation ‘has caused seniors to stay in the workforce longer, or come out of retirement to maintain their existing lifestyle or cover growing needs such as medical expenses.’

Joe Biden, out of office as of next January 20 when a new president is inaugurated, then most probably will be a retiree.

He’ll have government-paid protection, multiple government pensions, the millions of dollars he’s made over the years, his primary home and a massive vacation home, a long list of other government perks, all to sustain his “senior” years.

Many American seniors aren’t so privileged.

And many of those seniors have been staying in the workforce longer, or actually are giving up on their retirement and returning to the workforce, because of Biden’s economic policies – Bidenomics.

That would be the agendas Biden has pursued that have given Americans inflation of more than 20% since he took office, that have priced food and fuel up by 20%, 30%, even 40% since Biden’s reign in the Oval Office began.

A study from caring.com reveals the tragic situation facing America’s seniors because of Biden’s tenure:

“1 in 3 working seniors ‘unretired,’ returning to work after retirement.”

“52% of unretired seniors cite inflation as a primary reason they had to return to work.”

“Almost half of working seniors don’t plan on retiring in the next 5 years.”

“14% of retired seniors say they are likely to return to work.”

“1 in 15 seniors fear they could become homeless.”

The survey, with the help of Pollfish, took the opinions of 1,500 Americans ages 62-85.

It found that one-third of respondents now are working either part of the time or fulltime.

The report said, “Inflation is unpleasant for nearly all consumers, but it hits especially hard when you’re on a fixed income. The U.S. Bureau of Labor Statistics reported in May 2024 that consumer price indices for shelter and food continued to rise. According to the Senior Citizens League, adults who retired in 2000 have lost 36% of their buying power to inflation. Put another way: Retirees need over $500 more a month to maintain the lifestyles and buying power they had when they first retired.”

Faced with drastic lifestyle changes, including possibly selling their homes, the seniors instead have returned to work.

“Retirement plans for many seniors have been impacted by inflation — both due to a desired timeline for retirement and a less clear template for success with their investments amid inflation’s impact. These problems only compound for seniors relying on fixed income,” noted John Farrell, of Caring. “This has caused seniors to stay in the workforce longer, or come out of retirement to maintain their existing lifestyle or cover growing needs such as medical expenses.”

Other reasons cited by working seniors included paying medical debt, other debt, not enough savings, to learn a new skill and even to battle boredom.

Many also reported cutting back on leisure activities (60%), food (47%), and travel (57%) to cope with inflation.

And those seniors back at work report cutting back on the same items, “primarily to maintain their current living situation.”

Copyright 2024 WND News Center

The post ‘Unretirement’: Massive and Troubling Phenomenon Plaguing Seniors Victimized by Bidenomics appeared first on The Gateway Pundit.