Rivian, the electric automaker backed by Amazon, Ford and a cornucopia of heavy-hitting institutional investors like T. Rowe Price Associates and Coatue, finally made its once-confidential IPO filing public.

The company, which started in 2009 as Mainstream Motors before adopting the Rivian name two years later, has exploded in terms of people, backers and partners in the past few years. Rivian operated in secret for years before it revealed prototypes of its all-electric R1T truck and R1S SUV at the LA Auto Show in late 2018. Since then, Rivian has raised about $11 billion ($10.5 billion of which was raised since 2019); expanded its Normal, Illinois, factory; hired thousands of employees; landed Amazon as a commercial customer; and, most recently, filed confidentially for an IPO.

Now, its S-1 is revealing more details about the company and its operations. According to its IPO filing, Rivian is officially based in Southern California, a detail that, believe or not, wasn’t so clear a few months ago. The company’s headquarters previously were listed as Plymouth, Michigan.

As of June 30, 2021, Rivian had 6,274 employees across the United States, Canada, and Europe, according to its filing. The company has told TechCrunch more recently that it employs more than 8,000 people, an indication that its growth is accelerating. In addition to the Illinois factory and Plymouth office, Rivian has facilities in Palo Alto and Irvine, California as well as Arizona, Vancouver, Canada, the Netherlands and the U.K.

Media reports indicate that the company could pursue a valuation as high as $80 billion in its debut.

Certainly, there are a host of backers hopeful that that number – bandied about today as pre-IPO pricing numbers often are in companies that attract significant media attention – becomes reality. The TechCrunch crew has executed an initial dive through the company’s IPO filing, looking for intricacies, gems, and possible headaches now that we’ve digested the news itself.

So, let’s talk just how expensive it is to build an EV company, why market size estimates are bullshit, what sort of voting structure Rivian intends to sport post-debut, how Amazon is a blessing and a sticking-point for the company, why services matter, and where Tesla crops up.

Sound good? Let’s have some fun.

It’s expensive to build an actual EV company, despite what SPACs will tell you

Folks love to say that it’s cheaper and easier than ever to found, and build a startup. They are talking about pure-play software companies. It’s still incredibly difficult and expensive to build an EV company.

Evidence of that fact can initially be spotted in the sheer scale of capital that Rivian raised while private, just to get to the point when it has started to manufacture vehicles. But the company’s income statements shared in its S-1 filing are even more illustrative of the point.

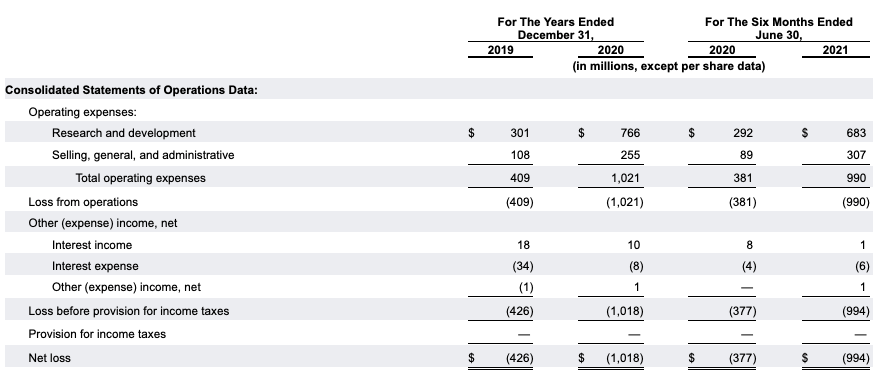

Here are the company’s operating results for 2019, 2020, and the first two quarters of both this year and the last:

No, we didn’t make a mistake and miss the revenue line from the above graphic. It doesn’t exist since. Because Rivian has essentially zero historical revenues to report; that of course makes sense because Rivian it is just starting to deliver the first R1T trucks (revenue yay!) to customers. You can spy a dribble of income in the interest section, but that’s effectively it; Rivian has only made money thus far from simply having lots of cash, some of which generated a paltry return.

Powered by WPeMatico