Anyfin, the Stockholm-based startup that enables consumers to refinance their existing loans, has raised $30 million in funding.

Leading the Series B round is EQT Ventures, with participation from existing investors Accel, Northzone and Rocket Internet’s Global Founders Capital (GFC). Anyfin says it will use the investment to “drive product innovation,” launch additional offerings and scale into new European markets (currently, the fintech operates in Sweden and Finland).

Launched in 2018 by Mikael Hussain (CEO), Sven Perkmann (CTO) and Filip Polhem (COO), Anyfin is on a self-described mission to improve the financial well-being of Europeans and “put them back in control of their finances.” It does this through a digital lending platform focused on refinancing. The idea is to make it easier to competitively refinance (or consolidate) loans and credit cards and therefore not get ripped off with high interest rates or compound interest.

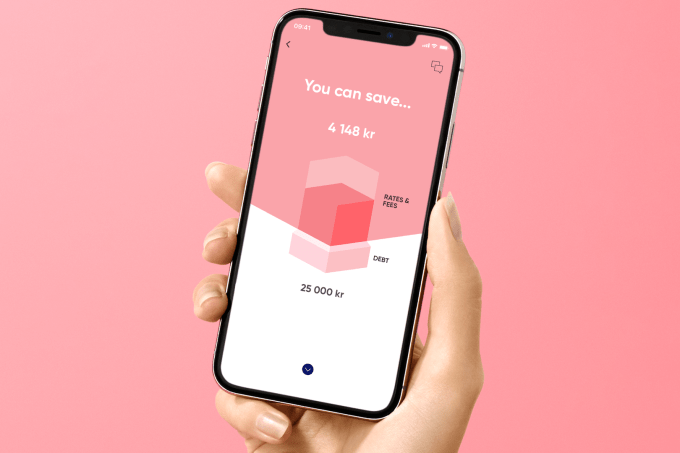

Via Anyfin’s website or iOS and Android apps, consumers can select their current loan provider from a drop-down menu, snap a picture of their statement or upload it. Anyfin then gives feedback, including, where applicable, the option to refinance at a “fairer” price. “With one tap, the consumer can accept the new option from Anyfin and the company takes care of settling the existing loan for them,” explains the Swedish fintech.

Behind the scenes, Anyfin claims to use AI, combined with publicly available consumer data and information garnered through taking a photo of your existing loan statement or uploading an electronic copy, including your repayment history. This, it says, gives it a more complete picture than your credit score alone, which is likely the main data point used by the original lender.

“All the consumer has to do to save a bunch of money is to snap a picture of the credit card bill or loan statement and we do the rest,” Anyfin co-founder and CEO Mikael Hussain told me in early 2018. “When a customer sends us their picture we use OCR to get the data we need, run that through our risk algorithms and, based on that, give the consumer an individual price.”

Cue statement from Ashley Lundström, deal partner and investment advisor at EQT Ventures: “The Anyfin team is one of the most experienced and ambitious fintech teams that the EQT Ventures team has come across. But what really impressed us was that Mikael, Sven, Filip and the stellar team they’ve built around them are truly value-driven. They’re in the game for the consumer, and never has this been more important. At EQT Ventures we believe that squarely aligning with consumers is a sustainable path to building a healthy business – so we were obviously thrilled to find the combination of tech DNA, market validation, and heart in Anyfin.”

Powered by WPeMatico