Payments giants and fintech startups in India on Saturday requested the central bank to treat widely used prepaid payment instruments on par with bank accounts for customers who have undertaken certain verifications, days after the monetary authority signalled industry-wide crackdown.

The Payments Council of India, a unit of influential industry body IAMAI, said in a letter to the Reserve Bank of India that by treating prepaid payment instruments — prepaid purchasing cards and wallets –- as bank accounts, regulated lenders will be able to disburse credit to customers who have performed their comprehensive know-your-customer verifications.

The Reserve Bank of India informed dozens of fintech startups earlier this week that it is barring the practice of loading non-bank prepaid payment instruments (PPIs) using credit lines, in a move that has prompted panic among — and existential threat to — many fintech startups, TechCrunch reported earlier.

Several startups including Slice, Jupiter, Uni and KreditBee have long used the PPI licenses to issue cards and then equip them with credit lines. Fintechs typically partner with banks to issue cards and then tie up with non-banking financial institutions or use their own NBFC unit to offer credit lines to consumers.

The central bank has long expressed concerns about lenders who are charging exorbitant interest rates and requiring minimum know-your-customer details to onboard and coerce customers. The industry body appears to be drawing a line between startups that have acted responsibly and bad players. (Banks as well as RBI-backed Rupay have been disbursing loans to full-KYC PPI accounts for years.)

The Payments Council of India did not name any startup in its letter to the RBI – though it used many examples to explain the two popular PPI models and their applications – but it represents nearly all payments firms including Mastercard, Visa, Paytm, PayU, PhonePe, Razorpay, Slice, PayPal and Stripe.

Fintech startups are estimated to be issuing over 600,000 prepaid cards to Indians each month. They have provided access to credit to nearly 10 million Indians, most of whom otherwise are not deemed worthy of loans by banks.

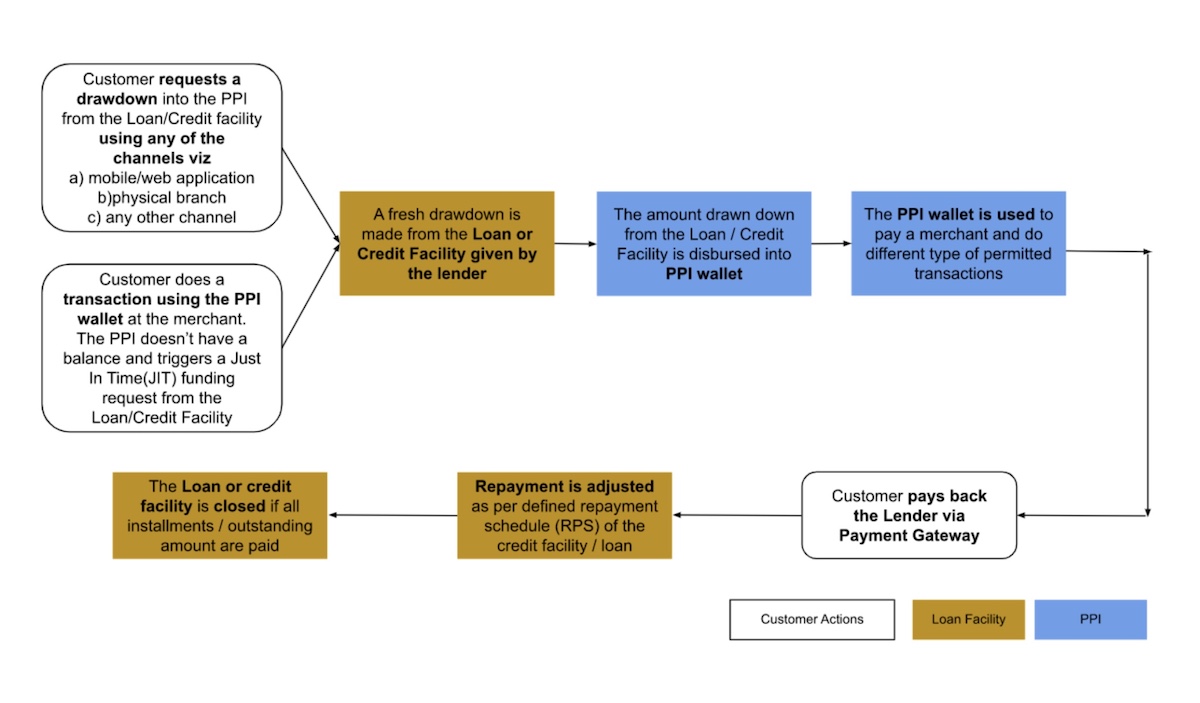

The Payments Council of India has also requested the central bank to permit drawdown by the customer from a non-revolving credit line to be disbursed into a full-KYC PPI.

The lobby group explains PPI models to the RBI. (Image sourced by TechCrunch)

Two more industry bodies — Digital Lenders Association and FICCI — have been working on letters to the RBI in recent days. On a Zoom call on Thursday, dozens of fintech officials discussed the common grounds for what they should inform the RBI. Some of their pressing requests include extending the timeline for the new rule by six months and establishing to the central bank that fintech industry at large is “responsible and trying to do the right thing,” TechCrunch reported earlier this week, citing multiple people on the call.

The RBI and IAMAI did not respond to a request for comment.

Powered by WPeMatico