- Ray Dalio will join a slate of newly appointed advisors to Indonesia’s sovereign wealth fund, Danantara. Indonesian President Prabowo Subianto announced the fund last month in a bid to consolidate the country’s state-owned enterprises in one place and help achieve his goal of reaching 8% GDP growth by 2029.

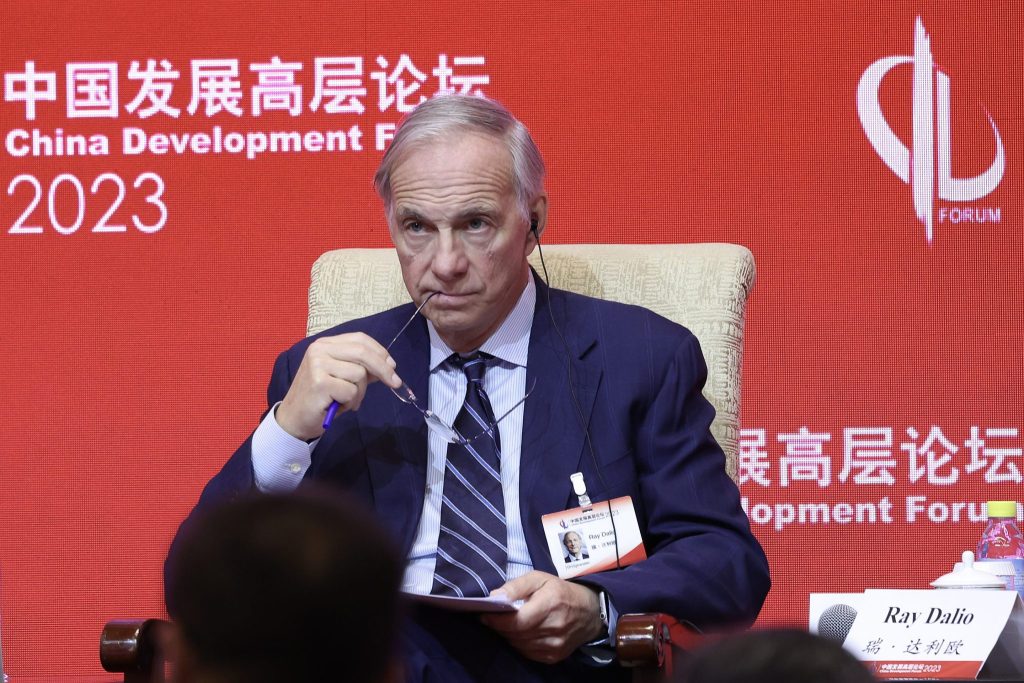

Legendary investor Ray Dalio will join Indonesia’s newly created sovereign wealth fund, Danantara, as a special advisor.

Dalio’s appointment is part of a “dream team” of new advisors the firm announced on Monday. Alongside Dalio, Danantara also appointed famed economist Jeffrey Sachs and the former Thai prime minister Thaksin Shinawatra.

Indonesian President Prabowo Subianto launched Danantara last month to much fanfare. The idea behind the new sovereign wealth fund was to consolidate Indonesia’s many state-owned enterprises under a single umbrella that would also have its own investment arm. The new combined company will eventually manage more than $900 billion in assets. Danantara’s initial investment budget for this year will be $20 billion, which the firm plans to spend across 15-20 projects.

Dalio met with Prabowo and Indonesia’s richest men at the presidential palace in Jakarta earlier this month, according to local reports. The meeting included the country’s largest magnates who have vast control over certain industries. Among the attendees were Indonesia’s richest man, Prajogo Pangestu, the real estate baron James Riady (who pled guilty to campaign finance violations in the U.S. in 2001), coal executive Garibaldi Thohir, and Franky Widjaja, whose agribusiness company dominates the palm oil market.

The appointment of Dalio and Sachs comes as Danantara faces questions from global investors about accountability and governance. Investors feared that because Danantara would report directly to Prabowo it would lack the oversight needed to ensure it delivered returns. There were also fears that Prabowo’s role could lead to political interference in investment decisions.

By naming trusted experts like Dalio, the founder of the world’s largest hedge fund, and Sachs, one of the world’s foremost experts on economic development, Danantara hopes to assuage the market’s concerns. Since the start of the year Southeast Asian markets saw a major selloff, with Indonesia hit particularly hard. Indonesian stocks fell to their lowest points in four years and the central bank made major policy interventions to stop its currency from slipping. The wobbly response from investors was a hit to Prabowo’s plan for Indonesian GDP growth of 8% by 2029.

Dalio’s understanding of Asian markets comes from his longstanding business relationships in China. During his more than 40 years of investing in China Dalio built strong ties to the business community and the government.

“I have pretty much always been involved in the Chinese markets,” Dalio wrote in a LinkedIn post in April. I got involved in the stock markets in China before the stock markets existed by helping in a small way those who created them, and I have invested in them beginning from when I was allowed to until now.”

Since the start of the year Chinese equities have been some of the best performing in the world. That has been welcome news for investors, after the last couple years in which the Chinese economy risked flatlining due to a property crash and a crisis of consumer confidence that led to reduced spending. With Chinese stocks returning to growth, many investors are pulling out of Southeast Asian markets, including Indonesia, and flocking to the relative safety of China’s rebounding economy.

This story was originally featured on Fortune.com