Olivier Douliery/AP

- With Election Day just one week away, some of Wall Street’s top investors are sharing their blue-wave plays for all to see.

- Joseph Mauro, head of markets at hedge fund Light Sky Macro, asked his followers on Thursday what their first trade would be if Florida is called early and points to an “overwhelming” Democratic sweep.

- Here’s how Mauro’s followers, from former hedge-fund giants to finance-Twitter fans, replied.

- Visit the Business Insider homepage for more stories.

Wall Street is finalizing its election-night bets. Some lock their insights within client-exclusive analyst notes and strategy calls.

Others are sounding off in a Twitter thread.

Joseph Mauro, head of markets at hedge fund Light Sky Macro, asked his 5,353 followers on Thursday what their first post-election trade would be if Florida is called early and points to “the most overwhelming blue wave in the history of American politics.”

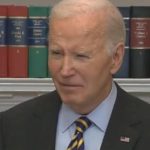

The hypothetical is far from unlikely. Recent polls suggest former Vice President Joe Biden maintains a healthy lead in the presidential race, and that Democrats will take control of the Senate. An early reading from Florida is also within the realm of possibilities, as the swing state is among those where mail-in ballots can be counted ahead of Election Day.

Here’s how Mauro’s followers, from Wall Street titans to finance-Twitter loyalists, plan to invest should Florida’s results point to a Democratic sweep.

Light Sky Macro managed $1.8 billion in assets as of December 31, according to a regulatory filing.

The professionals

Fade the consensus Blue Wave trades, i.e. buy bonds and buy dollars. – Raoul Pal, founder and CEO of Real Vision Group and Global Macro Investor

Long [Mexican peso]. – Paul McNamara, investment director at GAM Investments

Sell Bonds. – Mike Novogratz, former hedge-fund manager and CEO of Galaxy Investment Partners

Contrarian opinion — don’t do anything — just stay calm. There will be a lot of vol anyway. Pickup when the dust settles. – Kunal Shah, former Goldman Sachs analyst

The less-than-professionals

Buy Nasdaq fade macro portfolios. – CurateTheMess

Non-contrarian: MXN. Contrarian: short longer-dates breakevens and receive fwd inflation swaps. Stay away: gold, steepeners – PolicyError

Sell risk parity + don’t sell the USD – McMacro

Long CA and NY [municipal bonds] – Walter Sobchak

The comedians

Fading whatever is most-liked in your comments – FunkPhlex

Tissue companies, they gonna make a killing – Lord Ashdrake

Invest in a good bourbon to celebrate – Deep State Operative

Now read more markets coverage from Markets Insider and Business Insider:

Xilinx rockets 14% after finalizing agreement for $35 billion sale to AMD

Powered by WPeMatico